Evaluation of Trade and Investment Activities

Table of Contents (December 2013)

Executive Summary

Introduction

Western Economic Diversification (WD), as the federal department with the mandate for developing and diversifying the western Canadian economy, plays a key role in supporting western Canadians to participate in international markets given Trade and Investment's important contribution to economic growth. In recognition of these critical linkages, international trade and foreign direct investment have been a strategic priority for the department since 2007–08. Under the departmental Program Activity Architecture (PAA) from 2010–11 to 2012–13, WD's Trade and Investment activities have fallen under the Business Development program activity, and under the two sub-activities of Market and Trade Development as well as Foreign Direct Investment.

The department collaborates with federal, provincial and industry partners to assist small and medium-sized enterprises to prepare for and participate in international business, improve trade corridors of importance to Western Canada and enhance the capacity of the region to attract and retain foreign direct investment (FDI). The department works directly with not-for-profit organizations to achieve its Trade and Investment objectives. Types of Trade and Investment initiatives supported by WD include: Grants and Contributions (Gs&Cs) projects, the North American Platform Program (NAPP), Procurement and Industrial and Regional Benefits (IRBs), Asia-Pacific Gateway and Corridor initiatives, as well as Research and Advocacy.

The purpose of this project was to conduct an evaluation of the department's Trade and Investment activities in accordance with the Treasury Board Policy on Evaluation, focused on relevance and performance. The evaluation covered the time period from 2007–08 to 2011–12.

Method of Study

This project was undertaken in two phases. The first phase focused on the development of a Terms of Reference and a detailed evaluation work plan. The field research undertaken in the second phase of the project included a detailed document and literature review, project and database analyses, as well as interviews with 42 key informants, comprising WD management and staff and other federal, provincial, and regional government representatives. A client survey was conducted of 79 participants, comprising project recipients, project beneficiaries, project proponents that did not receive funding and organizations that did not apply for funding. Case studies were conducted of eight projects and focus group sessions were held in Winnipeg, Saskatoon, Edmonton and Vancouver, involving 37 participants.

Major Findings

Relevance: Continued need for Trade and Investment Activities

- Evidence from the evaluation indicates that stakeholders lack an understanding of the department's role in Trade and Investment. There is a need for the department to improve its coordination and collaboration with stakeholders in order to increase awareness of the departmental mandate with respect to Trade and Investment.

- Key informants and project recipients identified the need for projects that help small and medium-sized enterprises access new and emerging markets (e.g., export-readiness training, marketing to increase awareness of western Canadian capabilities and matchmaking services) and support for technology commercialization. Interviewees indicated that the need for support has increased and the nature of the need has changed over the past few years.

- Key informants perceived the department to be somewhat effective in identifying and responding to emerging needs and markets. The department's response was categorized as being reactive rather than taking a strategic and proactive approach to project funding. Gaps identified in the support provided include a lack of training and advice for small and medium-sized enterprises to help them acquire the necessary skills to engage in trade and attract investment, direct support for small and medium-sized enterprises, as well as support for specific costs related to Trade and Investment (e.g., travel and accommodation).

- Other organizations in Western Canada offer support for Trade and Investment activities including federal, provincial, regional and industry partners. Taken together, the services of these organizations are viewed as somewhat effective in meeting regional needs.

- On average, there was 18 percent likelihood that projects would have been implemented without assistance from the department. Most projects (67 percent) that applied for but were not approved for funding from the department did not go ahead.

Relevance: Alignment with Departmental and Federal government priorities

- Since 2007–08, WD's Report on Plans and Priorities identify Trade and Investment as a priority. Through this priority, the department contributes to the Government of Canada's Global Commerce Strategy and the National Policy Framework for Gateways and Corridors. The department's Trade and Investment activities also align with the Government of Canada's 2013 Economic Action Plan.

Relevance: Consistency with Federal Roles and Responsibilities

- The literature reviews done for the evaluation indicate that governments are in a unique position to help firms overcome trade barriers by providing access to networks in both the public and private sectors. Most key informants and almost all project proponents agreed that funding Trade and Investment activities is an appropriate role for the department, since it is consistent with the department's mandate to support economic diversification and growth in Western Canada.

Performance: Achievement of Expected Outcomes

- Key informants perceived that the department's Trade and Investment activities overall have been somewhat successful in meeting identified needs for support. Successful projects include those that support small and medium-sized enterprise participation at trade shows and in market exploration, promote western Canadian capabilities to potential foreign buyers or investors and build international partnerships and networks.

- Project recipients perceived their projects as successful in achieving their objectives, particularly with respect to increasing the interest of participating companies in expanding their business internationally. Focus group participants and respondents in the case studies agreed that the department had been successful in identifying and meeting the needs for specific projects.

- Although some projects are still underway, the Trade and Investment projects from the past five years have made good progress towards achieving their performance indicator targets. On an aggregate basis, 14 of the 21 indicators associated with two or more Trade and Investment projects have already been met and some are very close to being met.

- On the achievement of immediate outcomes from WD's Trade and Investment projects, key informants provided high ratings for outcomes related to the effectiveness of projects focused on developing new partnerships and networks and for projects focused on increasing awareness of Western Canada in priority markets.

- Other impacts generated by the department's Trade and Investment activities include the growth of emerging regional sectors, strengthened business relationships and economic spin-offs from the projects.

- Most WD funded projects led to further projects and investments, such as new investments or export deals and the continuation of projects and partnerships beyond the department's funding. Beneficiaries (project participants) reported their businesses to be successful in achieving their objectives, particularly in terms of expanding their networks and exploring potential opportunities.

- Key factors that contributed to the success of projects included: resources to link businesses to international markets (e.g., consultants and key decision makers at events), support and financial assistance from WD or from other government departments and provincial and industry sources. Factors that most commonly constrained or impeded the success of the projects included a limited time frame to meet targets, a lack of capacity amongst client organizations and project beneficiaries, limited financial resources and buy in from municipal and industry partners, as well as a lack of investor and buyer awareness of the region.

Performance: Demonstration of Efficiency and Economy

- Key informants and project recipients agreed that the objectives, target groups and activities of funded projects were well-defined and well-delivered. Some representatives were critical of the approval process, noting unclear and ambiguous processes for funding decisions and inconsistencies across regions with respect to the types and the costs of projects funded. Although many were satisfied with WD's support, several proponents noted the approval process was too slow and there was a lack of clear communication around guidelines and requirements.

- Departmental expenditures on Trade and Investment totaled $38.2 million and the total operating expenditure totaled $7.0 million over the period of the evaluation. This shows that it cost the department $1.0 to administer $5.4 in Trade and Investment transfer payments. These numbers highlight the relatively small operating cost in relation to the breadth and depth of Trade and Investment projects undertaken and the results realized. WD representatives somewhat agreed that the processes are in place to allocate and coordinate resources across the department, adding that better coordination and communication would be helpful.

- Key informants and project proponents viewed departmental funding as a catalyst for other sources of funds. Overall, each department dollar was matched by $1.4 from other contributors. An evaluation of Atlantic Canada Opportunity Agency's (ACOA) Trade and Investment program sub-activity conducted in 2010 indicated that on average, $0.99 was invested by other sources for every $1.00 invested by ACOA. The department's leverage ratio compares favorably to that of ACOA.

- A number of suggestions were offered for improvement. These include streamlining project approval and funding disbursement processes, clarifying and communicating what support is available and the eligibility criteria, improving internal governance structures and enhancing collaboration with federal, provincial, regional and industry partners. Other suggestions included the need to have better consistency and allocation of funds across regions, to be more proactive in seeking out partnerships and projects, to support small and medium-sized enterprises directly and to align programming to other regional development agencies with respect to Trade and Investment support to create a level playing field across the country.

Recommendations

The following recommendations are based on evidence gathered and conclusions discussed in this study:

Recommendation #1: The department should develop a consistent approach and provide clarity on Trade and Investment project costs and activities in all regions.

Recommendation #2: The department should work on increasing awareness of its Trade and Investment mandate through enhanced collaboration and coordination with federal, provincial and industry stakeholders.

Introduction

Western Economic Diversification (WD), as the federal department with the mandate for developing and diversifying the western Canadian economy, plays a key role in supporting western Canadians to participate in international markets given Trade and Investment's important contribution to economic growth. In recognition of these critical linkages, international trade and foreign direct investment has been a strategic priority for the department since 2007–08. Under the previous departmental Program Activity Architecture (PAA)1, the department's Trade and Investment activities belong to the Business Development program activity, under the two sub-activities of Market and Trade Development and Foreign Direct Investment. Within the department, there is also a designated horizontal International Competitiveness Team (IC Team) that leads and coordinates the majority of planned Trade and Investment activities in the department. The IC Team developed an International Trade and Investment Framework in 2008 and 2009 and a three-year Framework for 2010–13. The team has developed an annual work plan based on the three-year framework and prepared an annual report during this time period.

The Department for Foreign Affairs, Trade and Development (DFATD)2 is the lead department for foreign relations and international trade policies and programs in Canada. WD works with DFATD to contribute to a whole-of-government approach that enables Canadians to participate in global commerce and build a strong, stable economy. WD's Trade and Investment activities are guided by the Government of Canada's Global Commerce Strategy and Advantage Canada. In supporting international commerce opportunities for western Canadians, WD also works collaboratively with other federal departments, provincial governments, municipalities and industry associations. The department, similar to other Regional Development Agencies (RDAs), focuses on supporting Trade and Investment initiatives that address service gaps or enhance existing services in the region. WD, unlike other RDAs, does not work directly with small and medium-sized enterprises, but instead supports not-for-profit organizations as a way to provide indirect assistance to small and medium-sized enterprises.

Purpose of the Evaluation

The purpose of this project was to conduct an evaluation of WD's Trade and Investment activities over the past five years. In accordance with the 2009 Treasury Board Policy on Evaluation, the evaluation focused on relevance and performance (efficiency, effectiveness and economy).

The department's Trade and Investment activities were previously evaluated in 2008 as part of the Western Diversification Program evaluation. The scope of the current evaluation encompasses the following:

- All WD Trade and Investment activities from 2007–08 to 2011–12 fiscal years defined as all Grants and Contribution projects in Trade and Investment funded under the Western Diversification Program authority;

- The evaluation draws upon the findings in the 2012 North American Platform Program Evaluation and the 2012 Western Economic Partnership Agreement evaluation.

A list of the specific questions is provided in the following table.

| Evaluation Issues: | Evaluation Questions: |

|---|---|

| Need For The Program |

1. What are the key needs of Western Canada with regards to Trade and Investment (i.e. global readiness services)? Are the needs documented and complete? Is WD aware of the key Trade and Investment priorities in Western Canada? 2. Given WD's Trade and Investment priority, are actions focused and responding to emerging needs and core markets? Has WD adequately responded to the changing Trade and Investment environment? 3. To what extent are activities undertaken as part of the Market and Trade Development, and Foreign Direct Investment sub-activities consistent with the Trade and Investment needs in Western Canada and expected results of the department? 4. To what extent are WD's Trade and Investment activities aligned with departmental plans and priorities as well as government-wide priorities and strategies?

|

| Achievement Of Intended Outcomes | 5. How successful have the activities supported under Trade and Investment been in achieving the expected results? 6. To what extent do the results achieved through WD's Trade and Investment activities contribute to the achievement of strong small and medium-sized enterprises in Western Canada with an improved capacity to remain competitive in the Canadian economy and global marketplace? 7. What factors have facilitated and/or impeded the success of WD's Trade and Investment activities? How have these factors impacted the evolution of the department's involvement in Trade and Investment over time? |

| Demonstration Of Efficiency And Economy | 8. What mechanisms are in place to promote communication, share information and coordinate WD's Trade and Investment activities and resources within the department? How effective are these mechanisms in coordinating activities, sharing information and best practices, and limiting overlap and duplication? 9. To what extent are the resources allocated to Trade and Investment efficiently utilized? What improvements (e.g., alternative design/delivery options) can be made to increase efficiency? Are there changes that WD needs to consider to effectively address new and emerging issues in Trade and Investment? What is the level of client satisfaction with respect to approval processes and the level and type of support and services provided to clients? 10. To what extent is performance measurement being undertaken and used to link outputs, expected results and outcomes for WD's Trade and Investment activities? |

Structure of the Report

Section 2 presents a profile of the department's Trade and Investment activities while Section 3 provides a description of the methodology employed to conduct this evaluation. Section 4 describes the key findings of the evaluation and recommendations.

[1] A new departmental <abbr title=">PAA was implemented in FY2013-2014. Under the new PAA, the Market and Trade Development and the Foreign Direct Investment sub-activities were merged into the Trade, Investment and Market Access sub-program.

[2] This is the new name of the department; it was formerly known as the Department for Foreign Affairs and International Trade (DFAIT).

WD Trade and Investment Activities

WD collaborates with federal, provincial and industry partners to assist small and medium-sized enterprises prepare for and participate in international business, improve trade corridors of importance to Western Canada, as well as enhance the capacity of the region to attract and retain Foreign Direct Investment (FDI). The department works with not-for-profit organizations to achieve its Trade and Investment objectives. Types of Trade and Investment initiatives supported by WD include: Grant and Contribution (G&C) projects, North American Platform Program (NAPP), Procurement and Industrial Regional Benefits initiatives, Asia-Pacific Gateway and Corridor initiatives and Trade and Investment Research and Advocacy. These initiatives are described in more detail in the following paragraphs:

G&C Projects – Transfer payments are made in support of projects undertaken within the two Program Activity Architecture (PAA) sub-activities of Market and Trade Development and FDI under the authority of the Western Diversification Program (WDP). Sixty projects in the department's database were coded as Market and Trade Development and three projects were coded as FDI.

The department's role in FDI has generally been more selective given the role played by the provinces and regional and municipal economic development organizations in attracting FDI to their area. The department, however, has provided funding to provincial, municipal and industry organizations to carry out investment missions, including hosting foreign delegations visiting Western Canada as well as participating in investment missions abroad. While only a few of the department's G&C projects have been coded to FDI, many of the projects coded to Market and Trade Development also had a strong FDI component to them.

The following table represents investments in these 63 projects from the 2007–08 to 2011–12 fiscal years.

| WDP Initiatives | Number of Projects | Approved WD Assistance |

Total Funding | WD % |

|---|---|---|---|---|

| Conference Support Payments | 2 | $33,283 | $657,774 | 5% |

| Western Economic Partnership Agreements (WEPA) Round III (2008–12) | 16 | $11,532,671 | $42,883,021 | 27% |

| Western Diversification Program | 41 | $26,685,504 | $49,968,439 | 53% |

| WEPA Round II (2003–08) | 4 | $1,185,382 | $1,936,776 | 61% |

| Grand Total | 63 | $39,436,840 | $95,446,010 | 41% |

Source: WD Project Gateway Database

Some examples of the types of activities funded include:

- Global market engagement activities, including international business advisory services, international marketing strategies and promotional activities, trade shows, as well as trade and investment missions (e.g., supporting BC’s Four Host First Nations mission to Beijing, (WD support of $59,000 in 2008–09);

- Efforts to increase FDI into Western Canada, such as developing a program to attract and engage foreign investment during the 2010 Olympics (WD support of $805,000 in 2009–10); and

- International science and technology partnership activities, such as supporting an advanced malting and brewing laboratory and testing centre in Manitoba (WD support of $279,000 in 2009–10).

The following figure shows the number and amount of funding approved for G&C projects in the area of Trade and Investment by region and year. WD's support for Trade and Investment peaked in 2009–10, largely as a result of the 2010 Olympics, as well as support for several large WEPA projects.

Text Description, Figure 1: Trade and Investment (G&C) Project Approvals

North American Platform Program (NAPP) – Since 2003, the department has participated in two federal partnership programs to enhance Canada's relationship with the United States and Mexico and promote increased Trade and Investment with these countries. From 2003–08, the department contributed $5 million to the United States Enhanced Representation Initiative (ERI) and implemented 75 international business development projects (totaling $1 million) to support western Canadian companies pursuing opportunities in the United States. These successes led WD in 2008 to contribute another $3.75 million over five years (until 2013) to ERI's successor, the North American Platform Program (NAPP). NAPP builds on the results from ERI and provided a coordinated federal approach to advancing Canada's advocacy, trade and investment and science and technology interests with the United States and Mexico. A 2012 evaluation of NAPP conducted by DFATD found that the NAPP partnership facilitated the participation of thousands of Canadian businesses, industry and government representatives from across the country in activities and events that show-cased Canadian capacity. In addition, the NAPP partnership contributed to an increased awareness of Canadian interests and capacities and the training offered under NAPP to partners was highly valued and appears to have contributed to enhanced staff capacity and performance.

Procurement and Industrial and Regional Benefits (IRB) – The department plays an important role in supporting western Canadian firms to access Government of Canada IRB opportunities, particularly in the aerospace and defence sectors through its Advocacy sub-program activity. Departmental-supported initiatives under this priority have included trade shows, trade missions and market/product development projects. The Government of Canada's IRB Policy is part of the government's overall procurement process for major defence and security purchases and supports long-term industrial development across Canada by leveraging opportunities for small and medium-sized enterprises related to new major investments in military equipment. An evaluation of the department's advocacy function is scheduled for 2015–16 and will cover IRBs in more detail. The current evaluation focussed on IRB-related G&C projects that are linked to Trade and Investment and encourage western Canadian small and medium-sized enterprises to access the global supply chains of major international aerospace and defence companies.

Asia-Pacific Gateway and Corridors Initiative – The department has supported Western Canada's gateway and corridors – notably, the Asia-Pacific Gateway and Corridor Initiative (APGCI) and the Mid-Continent Trade and Transportation Corridor – to improve the region's ability to participate in global value chains by facilitating the shipment of goods to and from Western Canada to Asia Pacific and the United States and Mexico. The APGCI is a horizontal federal initiative that encompasses strategic investments and related policy measures to create a world-class transportation network that facilitates shipments between Canada and Asia Pacific, while the Mid-Continent Trade and Transportation Corridor links Western Canada through a connecting road and rail system to the American Midwest, Southwest and Mexico. The department has participated in several APGCI and related federal committees to advocate for Western Canada’s interests, including the Interdepartmental ADM Gateways and Corridors Committee and the Interdepartmental APGCI Steering Committee.

Through the APGCI, WD received $4.4 million to carry out two major initiatives: a) $4 million in 2006–08 to support the Fraser River Port Authority to dredge the Fraser River to maintain a competitive shipping channel; and b) $400,000 to carry out research initiatives to consult with western stakeholders about the economic potential and opportunities of the APGCI. Examples of the research initiatives include the following:

- North Asian Posts’ Study Tour of western Canadian science and technology capabilities;

- Western Canada’s Gateway Economy – the Asia-Pacific Foundation of Canada undertook a scan of successful international gateways and developed case studies to identify features that make them successful;

- Assessment of community economic needs – Saskatchewan and Manitoba organized stakeholder engagement sessions to identify gaps/needs to support communities to do business in Asia;

- China International Fair for Investment and Trade – WD developed promotional materials to encourage foreign investment into Western Canada; and

- Leading the Way – WD undertook case studies of successful Canadian companies in Asia to encourage other Canadian small and medium-sized enterprises to pursue opportunities in Asia.

Research and Advocacy – To provide further understanding around Western Canada’s participation in international markets, the department provides support to pan-western, multi-regional and regional Trade and Investment research initiatives. This activity also contributes to the department’s program activity (and related outcomes) in Policy, Advocacy and Coordination. Recent reports have examined North America’s trade and global value chains; trends in foreign direct investment in Canada; barriers to trade across the United States border; and ways to support Canadian small and medium-sized enterprises to pursue international markets. Additionally, in 2006, the department developed an investment marketing tool, “Western Canada: Where the Spirit of Innovation Finds a World of Opportunity” to attract foreign investment to Western Canada.

Evaluation Methodology

This section describes the design, methodology and limitations of the evaluation.

Evaluation Logic Model and Framework

A formal logic model was not developed for the department's Trade and Investment activities. The following logic model, which was designed to help conduct the evaluation reflects the activities, reach, outputs and outcomes in the Market and Trade Development and Foreign Direct Investment sub-activities within the Business Development program activity of the Program Activity Architecture (PAA).

| Activities |

|

|

|---|---|---|

| Outputs |

Market and Trade

|

Foreign Direct Investment

|

| Reach | Market and Trade: Federal departments, provincial/municipal governments; provincial/municipal/regional economic agencies; industry associations and small and medium-sized enterprises (indirectly) | Foreign Direct Investment: Provincial/municipal/regional economic agencies; potential and existing investors |

| Immediate Impacts |

Market and Trade

Increased capacity

Increased partnerships/networks

Improved trade infrastructure

|

Foreign Direct Investment Increased awareness

Increased capacity

Increased foreign investor interest in Western Canada

|

| Intermediate Impacts | Market and Trade – Increased participation in international markets through increased export capacity and sales for SMEs in Western Canada Foreign Direct Investment – Increase in foreign investment in Western Canada |

|

| Long-term | Strong small and medium-sized enterprises in Western Canada with an improved capacity to remain competitive in the global marketplace | |

This logic model summarises the inter-relationships between the activities, outputs and intended impacts of the department's support for Trade and Investment. The framework for the evaluation was developed based on this logic model.

Major Lines of Evidence

This project was undertaken in two phases. The first phase consisted of the development of the evaluation terms of reference and a detailed evaluation work plan. The plan outlined the strategies and methodologies which were then implemented in the second phase of the project. The field research undertaken in the second phase of the project included document and literature reviews, key informant interviews, case studies and focus groups.

Preliminary Consultations

Preliminary consultations were conducted with WD headquarters and regional staff to develop comprehensive lists of projects, key informant interviewees, survey participants and case studies. This led to the development of the terms of reference for the evaluation. The terms of reference, including the evaluation framework, was reviewed by the department's International Competiveness Team and senior management. Through these consultations, some preliminary evaluation information was also obtained.

Document and Literature Review and Project Database Analysis

A detailed review was conducted of the department's documents as well as literature relevant to WD's Trade and Investment activities. Project and performance information related to WD's Trade and Investment projects was generated from the department's project database and analysed. The document and literature review included:

- A detailed review of relevant policy documents developed by the department, including strategic plans, annual reports for the department's Trade and Investment activities, briefing notes, corporate plans and priority papers.

- Literature research related to Trade and Investment developed by experts.

- A review of past Western Diversification Program evaluation reports.

- A review of literature on Atlantic Canada Opportunities Agency's evaluation of its Trade and Investment activities.

Key Informant Interviews

In total, 42 key informants were interviewed. The following table provides the target number and number of completed interviews for each key informant group as well as a short description of each group's sample.

| Key Informants | Completed | Target Number | Description of Sample |

|---|---|---|---|

| WD Management and Staff | 18 | 20 |

|

| Other Federal, Provincial and Regional Government Representatives | 16 | 10 – 15 |

|

| Other Industry Stakeholders and Experts | 8 | 10 – 15 |

|

| Total | 42 | 40 – 50 |

The table below depicts the distribution of respondents across regions.

| Region | WD Representatives | Other Government | Industry and Experts | Total |

|---|---|---|---|---|

| Manitoba | 3 | 6 | 2 | 11 |

| Saskatchewan | 4 | 4 | 1 | 9 |

| Alberta | 3 | 4 | 2 | 9 |

| British Columbia | 2 | 2 | 3 | 7 |

| WD Policy and Strategic Direction Edmonton/Ottawa | 6 | 0 | 0 | 6 |

| Total | 18 | 16 | 8 | 42 |

All interviews with key informants were done by telephone. Interviewees were contacted at first by email and provided with a letter from the department that explained the purpose of the evaluation and invited them to participate.

Client Survey

The following table provides the target number and number of completed interviews for each client and beneficiary (i.e., project participants) group, as well as a short description of each group's sample.

| Target Group | Completed | Target Number | Description of Sample |

|---|---|---|---|

| Project Recipient Survey | 41 | 40 – 50 |

|

| Beneficiary (Project Participants) Survey | 25 | 20 – 25 |

|

| Proponents that applied but did not received funding | 8 | 5 – 10 |

|

| Organizations that did not apply for assistance from WD | 5 | 5 |

|

| Total | 79 | 70 – 90 |

The table below depicts the distribution of respondents across provinces.

| Province | Project Recipients | Beneficiaries/ Participants | Proponents That Were Not Approved | Organizations That Did Not Apply | Total |

|---|---|---|---|---|---|

| Manitoba | 7 | 13 | 0 | 1 | 21 |

| Saskatchewan | 11 | 4 | 2 | 1 | 18 |

| Alberta | 7 | 6 | 3 | 1 | 17 |

| British Columbia | 16 | 2 | 3 | 2 | 23 |

| Total | 41 | 25 | 8 | 5 | 79 |

Case Studies

Case study reviews were one of the critical lines of evidence for this evaluation. Case study reviews were conducted of 11 projects funded by the department delivered by eight recipients. The case studies were selected to include a cross-section of projects by province, type of project, size of project and type of recipient organization. The selection of specific projects for the case studies also took into consideration the stage of project development and input provided by departmental representatives regarding the projects. The case studies included at least two projects from each province. The mixture of projects focused on capacity building (international certification and global readiness services), international marketing and trade shows, investment attraction and trade infrastructure.

In conducting the case studies, the evaluation team collected and reviewed background information, including project proposals, progress reports, completion reports and other project outputs. Interviews with proponents of these projects were included as part of the key informant interviews. The list of case study recipients with a description of their projects is as follows:

- Alberta Women Entrepreneurs: One project to create a diversity certification and global supply chain access program for women business owners across Western Canada.

- Business Link Business Service Center in Alberta and Canada/British Columbia Business Services Society: Two projects to establish global business and export advisory services in Alberta and British Columbia.

- Canadian Hydrogen and Fuel Cell Association: One project to raise the profile of the hydrogen and fuel cell industry during the 2010 Olympics.

- Motion Picture Production Industry Association: One project to market and attract investment in British Columbia's film, television and digital production industry.

- Regina Exhibition Association: One project to attract new incoming buyers to the Western Canadian Farm Progress Show.

- Saskatchewan Trade and Export Partnership (STEP) and Manitoba Trade and Investment Corporation (MTIC): Two projects to host pavilions for western Canadian agricultural equipment manufacturers at the Agritechnica 2011 international tradeshow.

- Centreport Canada Incorporated: One project to start up and operate Winnipeg's inland port.

- Agence nationale et internationale du Manitoba: One project to support Centrallia 2012, an international business-to-business forum.

Focus Groups

In total, 39 representatives participated in four focus groups. The breakdown of participants is shown below.

| Key Informants | Vancouver | Winnipeg | Saskatoon | Edmonton | Total |

|---|---|---|---|---|---|

| WD Representatives | 1 | 2 | 2 | 53 | 10 |

| Other Provincial and Federal Government Representatives | 2 | 3 | 3 | 3 | 11 |

| Project Recipients and Industry Stakeholders |

4 | 6 | 4 | 4 | 18 |

| Total | 7 | 11 | 9 | 12 | 39 |

The participants were selected based on their knowledge and involvement in WD's Trade and Investment activities. Some were also interviewed as part of the key informant interviews and project recipient and proponent surveys. All participants were invited by email and telephone. The sessions were two hours in length.

Evaluation Challenges and Limitations

- Potential for respondent bias. The evaluation findings are based, in part, on the views of those with a vested interest in the program and potentially biased in their responses regarding outcomes. Several measures were taken to reduce the effect of respondent biases and validate interview results, including the following: (i) interviewers communicated to participants the purpose of this evaluation, its design and methodology, as well as the strict confidentiality of responses; (ii) interviews were conducted by telephone by skilled interviewers; and (iii) the respondents were asked to provide a rationale for their ratings, including a description of specific activities which contributed to the reported outcomes.

- Limited knowledge and familiarity of stakeholders with the department's Trade and Investment activities. Some respondents had difficulty recalling specific aspects of the department's Trade and Investment activities and were unable to comment on outcomes. In these cases, the evaluators obtained opinions on the needs and gaps to support Trade and Investment in their region, as well as any recommendations they had for the department's involvement in Trade and Investment.

- Low number of industry respondents in key informant interviews. There were a lower number of industry representatives and experts interviewed than were targeted. This was due in part to interviewing some industry representatives as project funding recipients instead of key informants. To address this limitation, a snowball sampling technique was applied in which some key informants were asked to recommend other representatives engaged in Trade and Investment in government or industry that were then interviewed.

- Project beneficiaries reporting for only 12 out of 42 projects. Most projects had no clear beneficiaries due to the nature of their activities. Project beneficiaries were selected from small and medium-sized enterprises or partners that participated in projects involving trade missions or trade shows. The responses of beneficiaries were used to complement responses from project recipients and to add examples and details of areas where some projects have achieved particular outcomes or follow-on investments.

- In reviewing the results of the focus groups, it is important to note that the discussion reflects the opinion of those who were in the room. The participants in the focus groups are not necessarily representative of all those who have been involved in WD's Trade and Investment activities. Given the nature of focus groups, the main conclusions do not necessarily mean that all participants spoke to all relevant issues or, if they had, would necessarily agree with the opinions which were expressed by others.

- Attribution: Determining the value added by the department's Trade and Investment activities is challenging over the long term because outcomes at the intermediate and long-term level are the result of many factors working together. This evaluation uses contribution-focused analysis to infer the department's role in achieving strategic outcomes that lead to developing and diversifying the western Canadian economy.

[3] Note: There were three representatives from WD Policy and Strategic Direction and two representatives from WD-Alberta Region at the Edmonton focus group.

Major Findings

This chapter summarizes the key findings of the evaluation gathered from all lines of evidence, grouped by evaluation issue and question.

Relevance

Continued Need for Trade and Investment Activities

An examination of eight key indicators in a research paper4 revealed that the global Trade and Investment environment has changed in many ways during the past decade. Emerging economies have become major world exporters, importers, foreign investors and recipients of inbound investment. Technology, environmental imperatives and shifting consumer tastes have given rise to new booming industries while pushing others quickly to the end of their life-cycle.

Highlights from the research paper indicate that:

- Prior to the global downturn, Canadian exports grew at an average annual rate of just 2.0 percent from 2000–08. In 2008 they were, in real (price-adjusted) terms, at the same level as a decade ago.

- Canada’s exporter population has shrunk noticeably since 2004, dropping from 42,500 to below 39,000 in 2008. The number of exporters with foreign sales of at least $5M was the same in 2008 as it was in 2000. The drop in the annual number of new exporters has been dramatic, falling from a peak of 5,400 in 2002 to 2,300 in 2008.

- Total import volumes (price adjusted) rose by close to 30 percent from 2000–08. Strong economic growth in Canada combined with a stronger dollar boosted demand for imported consumer goods, agri-food products, machinery and equipment.

- Canada’s international trade has become more diversified over the past decade with the relative share of exports to (and imports from) non-US markets rising significantly. In 2008, a quarter of Canada’s exports went to non-US markets compared to 16 percent in 2000. Similarly, the share of imported goods and services originating from non-US markets rose from 36 percent to 47 percent during this period.

- Canada’s trade diversification has included important changes in the composition of goods exported. The majority of manufacturing is down while energy, mining, primary metals, chemicals and pharmaceuticals exports are up significantly.

The report concluded that on the one hand, Canadian exporters have worked hard to adapt to the new global trading environment and to the surging Canadian dollar by adjusting their business practices to the realities of integrative trade.5 On the other hand, overall Canadian export growth has been limited, the number of exporters has fallen and growth in only a handful of sectors has managed to save the day for Canada’s trade performance. Concerted efforts will therefore continue to be required to ensure that Canadian exporters and their domestic suppliers remain relevant partners in a continuously evolving regional and global trade environment. This view of a concerted effort was shared in the key informant interviews, surveys and focus groups.

Evidence from the evaluation indicates that stakeholders lack an understanding of the department’s role in Trade and Investment. There is a need for the department to improve its coordination and collaboration with stakeholders in order to increase awareness of the departmental mandate with respect to Trade and Investment.

A common theme that emerged from all lines of evidence in the evaluation was the need for enhanced coordination and collaboration between government and industry with respect to Trade and Investment. Focus group participants indicated that there is a lack of understanding of the supports, programs and priorities set by the department with regard to Trade and Investment. Industry stakeholders indicated that the department’s policy of not providing direct funding to small and medium-sized enterprises has resulted in a low presence and involvement in meetings, consultations and other forms of direct communication with industry stakeholders. This was perceived to have resulted in a lack of awareness of the activities and supports offered by the department, as well as understanding of the department’s role with respect to Trade and Investment. Focus group participants recognize the existence of many services that provide support for Trade and Investment, and the need to increase awareness of each organization’s mandate in order to avoid duplication and facilitate partnerships and leveraging on specific projects. Key informants and project recipients noted the need to have increased coordination at federal, provincial and industry levels to support trade promotion and investment attraction in Western Canada.

Focus group participants emphasized the need for the department to take a leadership role to enhance coordination and collaboration of government and industry support for Trade and Investment in Western Canada. Key informants supported this and provided suggestions which include establishing a federal-provincial group chaired by the department to share information and facilitate relationship building between industry and government. Similarly, industry representatives suggested that the department be more proactive in communicating its activities to stakeholders or potential clients and share success stories with respect to funded projects.

One mechanism mentioned as having worked well in the past as an example of coordination and collaboration was the Regional Trade Network (RTN), which included federal and provincial trade partners, chaired by DFATD. In three of the four western provinces (Alberta, Saskatchewan and Manitoba), RTNs6 have been established to support information sharing and coordination between federal and provincial trade partners, although recently, these networks have had less of a presence with fewer, less frequent meetings.

Key informants and project recipients identified the need for projects that help small and medium-sized enterprises access new and emerging markets (e.g., export-readiness training, marketing to increase awareness of western Canadian capabilities and matchmaking services) and support for technology commercialization. Interviewees indicated that the need for support has increased and the nature of the need has changed over the past few years.

Key informants and project recipients identified other needs in Western Canada for greater support with respect to Trade and Investment. This includes:

- Support to access new and emerging markets, such as export-readiness training for new small and medium-sized enterprise exporters, helping existing exporters to expand into new and emerging markets (e.g., China, India, Brazil, and Russia) and increasing awareness of Canadian capabilities in these markets.

- Funding to ease the costs of trade development activities, tailored to industry needs, such as cost-sharing expenses of incoming buyers, covering travel and registration costs of small and medium-sized enterprises to attend trade shows and missions and funding the costs of consultants and business experts to help companies become export-ready and enter new markets.

- Technology commercialization and infrastructure support, such as support for demonstration projects and equipment purchases, increased access to capital, increasing awareness of Western Canada’s technology sectors and capabilities to investors, as well as the commercialization of products.

- Creating opportunities for matchmaking to link companies with potential buyers, partners and investors, including providing access to supply chains (e.g., in aerospace and manufacturing) and facilitating access to capital for small and medium-sized enterprises.

- Supporting programs to address skilled and unskilled labour shortages, in order to facilitate trade and attract investment, such as sector-specific labour needs (e.g., warehouse workers, trucking and supply chain and logistics experts).

Many key informants suggested that reduced federal and provincial support in combination with the slow recovery of the United States from the global recession and the emergence of new strong emerging economies has increased the need to better coordinate efforts and leverage funding to support Trade and Investment activities. Reduced federal and provincial support was attributed to the tightening of federal and provincial budgets and a reduced presence of DFATD in Western Canada. Other changes include more focus on information technology and clean technology, a less competitive Canadian manufacturing industry relative to the United States and the need for increased product development and commercialization.

Interviewees indicated that the increased complexity of international trade has given rise to more complex needs for western Canadian businesses. Complex needs may arise from government regulations in areas such as product standards or health and safety, the possibility of political intervention in some countries and the imposition of import duties or quotas on imports by other countries. This can cause problems especially for small and medium-sized enterprises that do not have the resources to obtain the necessary professional advice.

Key informants perceived the department to be somewhat effective in identifying and responding to emerging needs and markets. The department’s response was categorized as being reactive rather than taking a strategic and proactive approach to project funding. Gaps identified in the support provided include a lack of training and advice for small and medium-sized enterprises to help them acquire the necessary skills to engage in trade and attract investment, direct support for small and medium-sized enterprises and support for specific costs related to Trade and Investment (e.g., travel and accommodation).

Trade and Investment is identified as a priority need for the department in annual departmental corporate plans. Over the period of the evaluation, most Trade and Investments projects were funded through the Western Diversification Program and its sub-components, the Conference Support Program and the Western Economic Partnership Agreements (WEPAs). The department has also put in place an International Competitiveness (IC) Team to be the focal point for planning, coordinating, implementing and reporting on activities in support of Trade and Investment. In April of 2012, WD’s Executive Committee approved an Investment Strategy for the department along with an implementation timeframe for meeting specific departmental spending targets in priority areas, including Trade and Investment. The department estimates meeting its Trade and Investment target by 2015–16, ensuring that by 2015–16, 20 percent of the department’s annual G&C budget is spent in Trade and Investment (or roughly $21.5 million per year).

When asked to rate the effectiveness of WD in identifying and responding to emerging needs and markets, WD representatives provided an average rating of 3.2 on a scale of one to five where one is not at all effective, three is somewhat effective, and five is very effective. An example provided by the respondents was the NAPP Partnership, which was instrumental in facilitating the participation of Canadian businesses in events to showcase their respective capacities with business counterparts in the United States and Mexico.

The case studies revealed that several individual projects funded under the WDP were also responsive to the needs of the sector. These included:

- Business Link Business Service Center in Alberta/BC Business Services Society (Small Business BC): This involved two projects to establish global business and export advisory services in Alberta and BC. The department provided approximately 91 percent of the total project costs of $586,692. The funding recipients perceived that these projects would not have gone ahead without funding from the department.

- Saskatchewan Trade and Export Partnership (STEP) and Manitoba Trade and Investment Corporation (MTIC): This involved two projects to host trade pavilions for western Canadian agricultural equipment manufacturers at an international tradeshow, Agritechnica 2011. Funding recipients perceived the MTIC project as having a zero percent chance of going ahead without WD funding and the STEP project as likely to go ahead with a smaller vision and reduced scope. The department provided approximately 39 percent of the total project costs of $1,066,875 for the two projects.

About half of WD representatives identified some challenges associated with addressing emerging needs and issues. This includes the department’s approach to G&C funding which was described as being reactive to client proposals, instead of strategically and proactively identifying industry needs and pursuing projects responsive to those needs. This makes it more difficult for WD staff to link projects to a broader strategic framework and to understand and communicate to clients the reasons for funding decisions.

With respect to investment attraction, focus group participants indicated a need and a role for the department to increase awareness of potential investment opportunities (e.g., centralized investment information for potential investors as well as building the capacity of communities to attract investment). Key informants identified the need to fill the gaps left by a reduced federal presence in Western Canada for individual companies looking to establish connections and support from other federal departments, particularly in sectors such as aerospace, manufacturing and information technology.

Other needs or gaps identified by key informants and survey respondents include training and advice for small and medium-sized enterprises to help them acquire the necessary skills to engage in trade and attract investment, direct support to small and medium-sized enterprises, as well as support for specific costs (e.g., travel and accommodation to attend trade shows).

Other organizations in Western Canada offer support for Trade and Investment activities including federal, provincial, regional and industry partners. Taken together, the services of these organizations are viewed as somewhat effective in meeting regional needs.

When asked about other federal, provincial and regional organizations that are actively involved in providing support for Trade and Investment activities in the region, key informants and survey respondents identified a number of organizations. The table below provides examples of the list of organizations.

| Type | Organization |

|---|---|

| Federal |

|

| Provincial |

|

| Regional/Other |

|

When asked to rate the extent to which various organizations meet the regional needs for Trade and Investment support, other government and industry representatives provided an average rating of 3.5 and 2.9 respectively, on a scale from one to five, where one is not at all, three is to some extent, and five is to a great extent. Survey proponents that did not receive funding (i.e., proponents of projects that were not approved for funding and organizations that did not apply for funding) and project recipients that received funding provided ratings averaging from 3.2 to 3.3 respectively.

There was an eighteen percent (18 percent) likelihood that projects would have been implemented without assistance from the department.

Over half (55 percent) of project recipients reported that their projects were completed at the time of the evaluation. Some projects where underway (41 percent), one project was canceled and one recipient did not know the status of their project.

As demonstrated in the figure below, 53 percent of project recipients noted that there was no likelihood that their project would have gone ahead without assistance from the department and an additional 34 percent noted that the chances were low (25 percent likelihood). A few recipients (eight percent) noted that the project had a 50 percent chance of going ahead and two recipients suggested that their project would have gone ahead without departmental funding. Analysis of responses indicated that there was an 18 percent probability that projects would have been implemented without any sort of funding assistance from the department.

Text Description, Figure 2: How likely is it that the project would have gone ahead without assistance from WD?

Project recipients that noted there was no likelihood the project would have gone ahead explained that they did not have enough funding to undertake the project. A few noted that the project would have been delayed or reduced in scope, and that there would not have been the same level of collaboration. Recipients of projects that would have gone ahead without WD funding noted that the priorities established for their projects were already set by industry.

Most projects (67 percent) that applied for but were not approved for funding from the department did not go ahead.

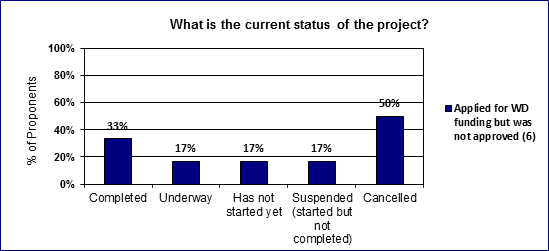

As demonstrated in the figure below, sixty-seven percent (67 percent) of projects that applied for but were not approved for funding did not go ahead. Half of the projects were canceled (50 percent) and one was suspended due to a lack of funding to undertake the full scope of activities that was intended. One project has not started yet and is still looking for additional sources of funding or will be scaled down. Three projects went ahead as planned.

Text Description, Figure 3: What is the current status of the project?

Of the three projects that went ahead, proponents explained that the projects were somewhat successful since they were in high demand. Some proponents did not apply to the department for funding because their project did not meet departmental funding priorities or criteria. Some of these went ahead with funding from private sector, provincial, and other federal departmental resources.

Alignment with Departmental and Federal Government Priorities

The department’s Trade and Investment activities supported its strategic outcome of a growing and diversified western Canadian economy. Since 2007–08, WD’s Report on Plans and Priorities identify Trade and Investment as a priority to enhance small and medium-sized enterprise participation in global markets, create value-added opportunities through Western Canada’s trade gateways and corridors initiative and raise Western Canada’s visibility as a competitive investment location. Through this priority, the department contributes to the Government of Canada’s Global Commerce Strategy7 and the National Policy Framework for Gateways and Corridors8. The priorities of these key national policy frameworks are to strengthen relations with the United States and other priority markets, open new international markets via free trade agreements, enhance the flow of goods and services through gateways and corridors and encourage foreign investment.

WD’s Trade and Investment activities also align with the Government of Canada’s 2013 Economic Action Plan.9 The Economic Action Plan includes measures to enhance Trade and Investment by strengthening the global competitiveness of Canada’s manufacturing sector (e.g., tax relief to enable businesses to invest in new machinery and equipment), furthering Canada’s trade agenda to support access to high-growth markets and enhancing Canada’s foreign trade zone policies and programs. Most key informants indicated that the department’s Trade and Investment activities are largely consistent with the current priorities of the department and the federal government, as well as current regional priorities.

Consistency with Federal Roles and Responsibilities

A 2011 Trade Promotion Analytical Paper10 concludes that exports generate benefits for the economy both directly and indirectly, have a positive effect on productivity and are associated with firms that invest in research and development and are more innovative. The paper notes that firms face a number of barriers to entering export markets, including dealing with legal or tax regulations or standards, identifying contacts in the market and obtaining basic information to facilitate market entry. The paper concludes that the government is in a unique position to help firms overcome these barriers by providing access to a wide range of networks in both the public and private sectors. Evidence in the paper indicates that it is cost effective for governments to address these issues by providing assistance to firms seeking to internationalise and/or enter new overseas markets. This is supported by a World Bank study11 that analysed data for 104 developing and developed countries and found that on average every $1 spent by an export promotion agency on export promotion generated a $40 increase in the country’s exports.

Most key informants (83 percent) and almost all project proponents (100 percent of project recipients; 92 percent of non-funded proponents) agreed that funding Trade and Investment activities represents an appropriate role for the department, since it is consistent with the department’s mandate to support economic diversification and growth. They indicated that the department is uniquely positioned to support the West. Those key informants that responded “somewhat” (13 percent) noted that there is a role for the department as long as there is collaboration and coordination with federal, provincial and industry players in order to avoid duplication of efforts.

Other government and industry representatives see the main role of the department as providing G&C funding for projects, partnering with other government organizations to leverage funding, building export readiness and encouraging the growth of small and medium-sized enterprises.

Performance: Achievement of Expected Outcomes

Achievement of Objectives

The 2010–11 to 2012–13 departmental Program Activity Architecture (PAA)12 lists outcomes derived under the Market and Trade Development and Foreign Direct Investment sub-activities as follows:

- Market and Trade: To build western Canadian companies' capacity and knowledge in international business development in order to increase their penetration into international markets.

- Foreign Direct Investment: To enhance the capacity of Western Canada to attract and retain foreign direct investment by increasing awareness of this market among foreign investors.

Both sub-activities lead to the expected result of having strong small and medium-sized enterprises in Western Canada with an improved capacity to remain competitive in the global marketplace under the Business Development program activity area of the PAA.

Key informants perceived that the department’s Trade and Investment activities overall have been somewhat successful in meeting identified needs for support. Successful projects mentioned include projects that support small and medium-sized enterprise participation at trade shows and in market exploration, promote western Canadian capabilities to potential foreign buyers or investors and build international partnerships and networks.

When asked to rate the extent to which WD’s Trade and Investment activities have been successful in meeting the needs identified, on a scale from one to five, where one is not at all successful, three is somewhat successful and five is very successful, key informants provided an average rating of 3.4. Key informants explained that the department’s Trade and Investment activities have been particularly successful with respect to supporting:

- Individual projects, which helped expose small and medium-sized enterprises to international markets and attract international investment. Specific examples included: facilitating participation in international trade shows and events (e.g., Agritechnica, Centrallia and Game Developers Conference); technology partnership projects (e.g., incubator program for tech industry in Silicon Valley and India); and projects to attract foreign investment and facilitate trade (e.g., Global Transportation Hub in Saskatchewan).

- Events and initiatives that bring various partners together to leverage funding, build the capacity of industry associations so they can better support their members and raise awareness of western Canadian capabilities abroad (e.g., study tours and incoming buyers programs).

Project recipients perceived their projects as being successful in achieving their objectives, particularly with respect to increasing the interest and participation among companies in expanding their business internationally.

Project recipients perceived the objectives of their projects to include both quantitative objectives such as increasing export sales, attracting investment, and increasing export-ready companies, as well as qualitative objectives such as increasing awareness, exposure and access to new markets. Project recipients provided an average rating of 4.4 when asked to rate the success of their project in achieving (or will achieve if not complete) their objectives, on a scale from one to five, where one is not at all successful, three is somewhat successful and five is very successful. As shown in the table below, the majority of project recipients (92 percent) perceived that their project was successful or very successful in achieving its objectives.

Text Description, Figure 4: Perceived success of the project’s achievement of its objectives

Most proponents indicated that their project was successful because it generated interest and participation among companies in expanding their business internationally. Other reasons noted included increased export sales, the achievement of specific performance indicators and leads to other projects and opportunities. Recipients of projects that were less successful noted that their project lacked industry buy-in and financial support.

Focus group participants and respondents in the case studies agreed that the department had been successful in identifying and meeting the needs for specific projects.

Focus group participants indicated that the department has been successful in funding activities that connect businesses to markets (e.g., business-to-business events). Participants also agreed that in some cases these activities are less likely to be approved for funding since the impacts are not immediate. Key informants noted that it was not always clear why some projects or costs are approved or not approved for funding. Focus group participants recognize that more could be done to increase outreach and communication of the department’s objectives and mandate with respect to Trade and Investment.

Case study respondents provided a rating of 4.7 on a scale of one to five, where one is not at all successful, three is somewhat successful and five is very successful on the success of their projects in meeting their objectives. The Alberta Women’s Enterprise project to develop a diversity certification and global supply chain access program was mentioned as having exceeded expectations in terms of revenues and how quickly businesses grew. The Motion Picture Production Industry Association of British Columbia project to market and attract investment to the province’s film, television and digital production industry helped to connect industry associations and groups.

Performance Measurement13

Although some projects are still underway, the Trade and Investment projects from this period have already made good progress towards achieving their performance indicator targets.

The performance measurement system used by the department requires project recipients to collect and report data on a number of agreed upon standard and unique performance indicators (usually up to a maximum of five indicators per project). Prior to projects being approved, targets are established for each indicator. Throughout project implementation, recipients provide periodic updates to the department on performance indicators and targets. During the surveys conducted with project recipients as part of this evaluation, recipients were asked to provide updates on their respective performance indicators.

The following table provides a list of the 21 performance indicators associated with two or more of the 63 Trade and Investment projects funded during the evaluation time period. It also includes the number of projects using each indicator, the aggregated target numbers and the progress made on each indicator within the evaluation period.

| Common Performance Indicators | Number of Projects Using the Indicator | Aggregated Target of Approved Projects | Total Progress on Each Indicator | Status |

|---|---|---|---|---|

| PAA Indicators: | ||||

| # co's participating in export and market development initiatives | 34 | 8,946 | 9,217 | Exceeded |

| # projects promoting participation in major international events | 15 | 78 | 50 | Not Met |

| # industry association partnerships created | 12 | 80 | 238 | Exceeded |

| # export ready companies | 7 | 480 | 539 | Exceeded |

| $ in direct investment facilitated by WD | 3 | $8,900,000 | $175,576,000 | Exceeded |

| Unique Indicators:* | ||||

| # jobs created or maintained | 4 | 819 | 354 | Not Met |

| # business/export contacts | 4 | 56 | 112 | Exceeded |

| # business leads | 4 | 1,490 | 3,557 | Exceeded |

| # businesses created, maintained or expanded | 4 | 63 | 38 | Not Met |

| $ export sales generated | 3 | $7,950,000 | $30,300,000 | Exceeded |

| $ investments generated | 4 | $91,500,000 | $106,190,000 | Exceeded |

| # businesses trained/advised | 8 | 723 | 1,935 | Exceeded |

| # businesses using service (e.g., Website, telephone service, business incubator) | 7 | 11,404,480 | 11,404,790 | Exceeded |

| % satisfaction of clients/partners | 4 | 77% | 86% | Exceeded |

| # export plans developed | 4 | 154 | 112 | Not Met |

| # stakeholders engaged | 2 | 15 | 11 | Not Met |

| # networks or partnerships created, maintained, or expanded | 10 | 618 | 558 | Not Met |

| # companies attending an event (e.g., symposium) | 3 | 1,010 | 878 | Not Met |

| # missions | 2 | 19 | 21 | Exceeded |

| # incoming buyers | 3 | 760 | 1,113 | Exceeded |

| # marketing events/activities | 3 | 57 | 72 | Exceeded |

*Note that the unique indicators were categorized according to key themes and tabulated accordingly. The table lists only those indicators that were identified by more than one project. In total there were 133 unique indicators and five PAA indicators for the 63 Trade and Investment projects.

As demonstrated in the table, on an aggregate basis 14 of the 21 indicators have already been met and some are very close to being met. In particular, the projects have met or exceeded their targets in terms of partnerships (e.g., number of industry association partnerships created), the number of export ready businesses (e.g., number of export ready companies and number of businesses trained/advised) and in generating Trade and Investment business (e.g., direct investment facilitated by WD, number of business leads, export sales and investments generated, and number of incoming buyers and missions). The projects are very close to meeting their targets in terms of the number of companies participating in export and market development initiatives. The indicators that have yet to achieve targets include the number of projects promoting participation in major international events, the number of jobs created or maintained and the number of businesses created, maintained or expanded.

Immediate Outcomes of Trade and Investment

Key informants were asked to rate the effectiveness of the department’s Trade and Investment activities to achieve different outcomes, on a scale from one to five, where one is not at all effective, three is somewhat effective and five is very effective. As illustrated in the following chart, the overall average ratings of effectiveness of WD’s Trade and Investment activities in generating outcomes among WD representatives ranged from 3.9 for effectiveness in developing new partnerships and networks to 3.1 for effectiveness in encouraging or attracting foreign investment. The overall average ratings amongst other government representatives ranged from 4.2 for projects focused on increasing awareness of Western Canada in priority markets to 3.1 for projects focused on increasing the ability of participating organizations to develop or expand into new export markets and increasing export sales and revenues.

Text Description, Figure 5: To what extent have WD’s Trade and Investment activities in generating outcomes among WD’s activities in Trade and Investment been effective in generating this outcome?

Examples of the effectiveness of WD’s Trade and Investment activities in generating outcomes as identified by key informants include:

- Facilitating participation at international trade shows, e.g,. Agritechnica 2011 trade show which resulted in $2 million in immediate sales at the show and $45 million in sales in the medium-term among Manitoba agricultural machinery and equipment manufacturers;

- Facilitating partnerships through NAPP projects and supporting international technology partnerships;

- Funding specific initiatives to attract foreign investment, e.g., Centrallia show in Winnipeg that brought together 712 business leaders from 500 different companies and organizations to participate in 5,210 business-to-business meetings and showcase BC fuel cell and hydrogen technologies at the 2010 Olympics; and

- Supporting outgoing missions and incoming buyers programs.

Case studies conducted for the evaluation supported the views of key informants of how projects have achieved their immediate outcomes.

- Alberta Women Entrepreneurs initiative to create a diversity certification and global supply chain access program. Targets established for this initiative were exceeded. About 71 women entrepreneurs were reported as being certified. The most significant target to be exceeded was that businesses that participated in trade missions, supplier diversity procurement meetings and meetings with procurement professionals within multi-national supply chain corporations secured at least $19 million of new contracts with multi-national corporations during the duration of the project.

- The Canada/British Columbia Business Services Society initiative to establish a trade advisory service for potential exporters. Two targets established for this initiative were exceeded and the remaining two were close to being met. The project resulted in approximately 809 companies participating in export preparedness training initiatives, 23 export ready companies and 14 partnerships.

- The Saskatchewan Trade and Export Partnership initiative to generate exposure for the agricultural industry, to produce leads and sales for specific agricultural equipment, to make agreements for future business and to arrange distribution deals for their equipment. All targets established for this project were exceeded. The project resulted in approximately 24 companies participating in export and market development initiatives, 277 business leads and about $20 million in export sales.

- The CentrePort initiative to start-up and operate Winnipeg’s inland port. Most of the targets established for the project have been met or exceeded. Case study respondents indicated that the project contributed significantly to increasing awareness of Western Canada in emerging international markets. The project have resulted in 121 companies partnering in export and market development, 44 industry association partnerships and a number of spin-off infrastructure projects.

Other impacts generated by the department’s Trade and Investment activities include the growth of emerging regional sectors, strengthened business relationships and economic spin-offs from the projects.

Additional impacts generated by the department’s Trade and Investment activities noted by key informants include:

- Growth of emerging regional sectors (e.g., music, film industry, bio-products, functional foods);

- Economic spin-offs of activities (e.g., tourism, hospitality industries);

- Fostering synergies (e.g., connecting stakeholders to the Government of Canada in discussions);

- Raising the profile of the department in the private sector through Industrial and Regional Benefits activities; and

- Signing of a Memorandum of Understanding between a western Canadian organization and a similar entity in the United States and Mexico.

When asked to describe other impacts generated by the projects, most project recipients noted that their project had strengthened business-to-business relationships and increased the number of companies engaged and interested in pursuing trade. Other impacts noted included new product development (e.g., enhanced technology and innovation) and increased public awareness regarding export markets.

Most WD-funded projects led to further projects and investments, such as new investments or export deals and the continuation of projects and partnerships beyond the department’s funding.

Most recipients (70 percent) indicated that their project directly led to further initiatives, investments or developments by their organization or other organizations, as shown in the figure below.

Text Description, Figure 6: Did this project directly lead to other projects, investments or developments by your organization or other organization involved in this project?

Recipients described different projects and investments generated by their projects, such as new investments or export deals, the continuation of projects and partnerships beyond the department’s funding. Examples included the Whitecap Development Corporation project in Saskatchewan to fund a technical assessment for an industrial park to enhance procurement opportunities. The technical assessment done resulted in the leasing of a lot for the business park and the construction of a building (total investment of $2.7 million). The CentrePort project to start and operate an inland port in Winnipeg contributed to the provincial government decision to fund $912 million in road construction projects.

Beneficiaries (projects participants) reported their business to be successful in achieving their objectives, particularly in terms of expanding their networks and exploring potential opportunities. Beneficiaries indicated they were particularly effective in increasing the ability of their businesses to develop or expand into new export markets.

Project beneficiaries described their involvement in a department sponsored project as being aware of the project but not directly involved, having worked on the project, engaged as a participant in the project, involved in a committee or as a key stakeholder.